NOTE: This video is previous coverage from 5/17/25

VIRGINIA BEACH, Va. (WAVY) – The Virginia Beach Restaurant Association (VBRA) is raising awareness about a new legislative policy that will go in effect on July 1 if reverse action is not taken.

The City of Virginia Beach (VB) will raise the restaurant meals tax from 5.5% to 6.0% next Tuesday in order to “support the newly established Major Projects Fund.”

This tax is also an effort to raise city wide revenue since “restaurant revenue growth has slowed slightly due to inflationary pressures in the economy,” according to the city.

This is a 0.5% increase that will not only impact consumers, but restaurant owners and franchises in the area.

The VBRA president Debbie Lou Hague told 10 On Your Side that she worries the meals tax increase will drive people away from Virginia Beach.

“It’s a state tax and a city tax. So, it’s state 6% and now July 1, it will be city 6% that’s 12% on your meals,” Lou Hague said. “We try to bring people into town, and so they may go to other places instead of coming here because of their meals tax.”

Other restaurant owners are also worrying about how it could impact business.

“We’re just getting hit in many different ways, and it’s tough on our industry,” Bill Dillon, Owner of Abbey Road Pub and Restaurant, said.

To take action, the VBRA has created a citywide petition advocating for a “reduction of the meals tax to 3.5%, with a long term goal of eliminating it altogether.”

“Our businesses are already struggling with rising costs, staffing challenges, and economic pressure. This tax will lessen customer traffic and force more local restaurants to close. National chains may survive; independents will not,” the petition states.

Through this petition and a letter directed to city leaders, the VBRA hopes the city will listen to their concerns.

“We have over 1000 restaurants in the city of Virginia Beach, and so it’s affecting every single person that goes to a restaurant, every single person owns a restaurant, and the 1000s of people who are employed with restaurants,” Hague said.

The earliest meal tax was implemented in Virginia Beach in 1965 at 3%, the city confirmed to WAVY.

From that point, the rate has changed several times:

- May 15, 1981. Rate goes from 3 cents to 6 cents.

- May 14, 1982. Rate goes from 6 cents to 5 cents.

- May 12, 1983. Rate goes from 5 cents to 4 cents.

- Dec. 19, 1988. Rate goes from 4 cents to 4.5 cents.

An ordinance adopted May 15, 2001 raised the meal tax to 5.5%.

Outside of this petition, the VRBA has also listed various ways one can support this initiative. One emphasizing the importance of local elections, and to “learn” where local candidates stand on the meals tax before the next election cycle.

The VBRA also encourages residents to continue to dine locally and support local restaurant owners in hopes to protect the “character and charm of Virginia Beach.” Adding that the “fragile economic environment” hits harder for some businesses rather than others.

A spokesperson for Virginia Beach sent 10 On Your Side a statement about the situation that reads as follows.

“The City of Virginia Beach understands that any tax increase can have an impact on our residents, visitors and business community. The City is experiencing a significant cost increase in capital projects which is largely being driven by inflation. As a part of the budget development process, several projects were deleted and rescoped, long standing dedications were redirected toward priority projects, and after all of these efforts a gap still remained resulting in the need for the 0.5% meals tax increase. The redirection of these resources and meals tax increase are dedicated to a newly established Major Projects fund. The details of this fund and the priority projects can be reviewed in more detail on page 13 at the following link: https://s3.us-east-1.amazonaws.com/virginia-beach-departments-docs/budget/Budget/Proposed/FY-2026/Final-Council-Reconciliation-Letter-With-Attachments.pdf

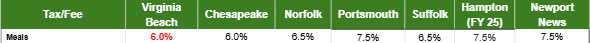

For additional context, the following table reflects how Virginia Beach’s meals tax rate compares to other Hampton Roads localities. Based on economic estimates, nearly 40% of meals tax revenue is generated by out of town visitors.” -Ali Weatherton-Shook, Public Information Liaison

Click here for a link to the petition, and down below for a copy of the letter to the city.