NEW YORK (AP) — U.S. stocks are drifting lower Monday ahead of potential flashpoints looming later in the week that could bring more sharp swings for financial markets.

The S&P 500 fell 0.5% in late morning trading, coming off a winning week in its whipsaw ride that’s been rattling investors for weeks. It had slightly more gainers than losers, but pricey technology stocks were losing ground and weighing down the index.

The Dow Jones Industrial Average was down 18 points, or 0.1%, as of 11:40 a.m. Eastern time, and the Nasdaq composite was 0.9% lower.

The relatively calm trading offers a respite following historic swings that have come as hopes rise and fall that President Donald Trump may back down on his tariffs, which investors expect would otherwise cause a recession. The S&P 500 has roughly halved its drop that had taken it nearly 20% below its record set earlier this year.

This upcoming week will feature earnings reports from some of Wall Street’s most influential companies, including Amazon, Apple, Meta Platforms and Microsoft. Their performances carry huge sway over the market because they’ve inflated to become the biggest by far in terms of size.

Outside of Big Tech, executives from Caterpillar, Exxon Mobil and McDonald’s may also offer clues about how they’re seeing economic conditions play out. Several companies across industries have recently been slashing their estimates for upcoming profit or pulling their forecasts completely because of uncertainty about what will happen with Trump’s tariffs.

“We heard more plans to mitigate tariff impacts than in prior months and than during 2018” from U.S. companies, including pre-ordering, shifting production and increasing prices for their own products, according to Bank of America strategist Savita Subramanian. But she also said in a report that she’s seeing “some indications of a pause: no hiring/no firing, no new projects/no cancellations etc.”

A fear is that Trump’s on-again-off-again tariffs may be pushing households and businesses to alter their spending and freeze plans for long-term investment because of how quickly conditions can change, seemingly by the hour.

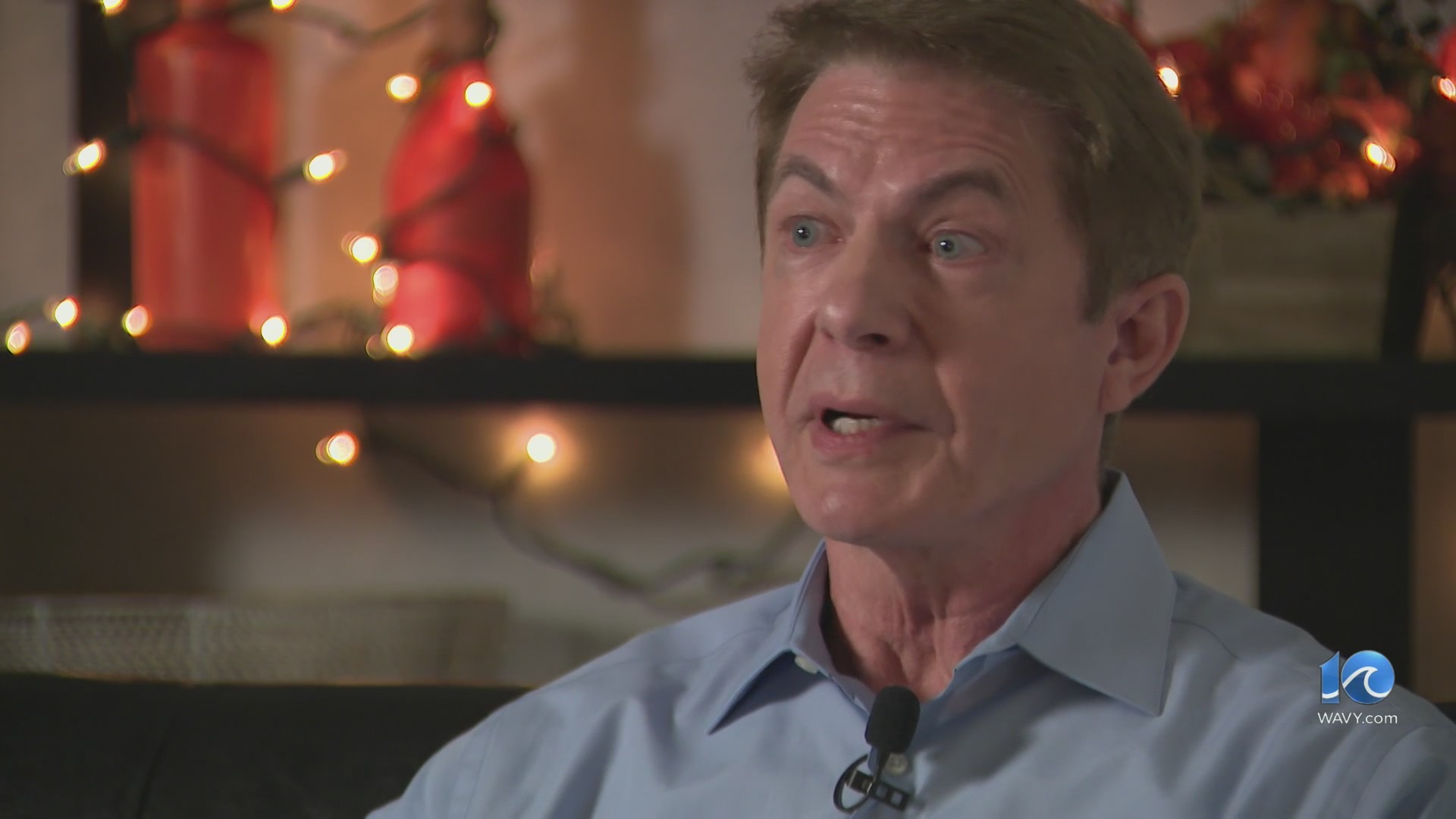

Domino’s Pizza was flipping between small losses and gains after it reported weaker profit for the latest quarter than analysts expected. The pizza chain’s CEO, Russell Weiner, called the global economic environment “challenging,” and its stock was most recently up 0.3%

DoorDash rose in early trading after Deliveroo, the food delivery service based in London, said it heard from DoorDash about a possible cash offer to take over the company. It was most recently up 0.2%

So far, economic reports have mostly seemed to show the U.S. economy is still growing, though at a weaker pace. On Wednesday, economists expect a report to show that U.S. economic growth slowed to a 0.8% annual rate in the first three months of this year, down from a 2.4% rate at the end of last year.

But most reports Wall Street has received so far have focused on data from before Trump’s “Liberation Day” on April 2, when he announced tariffs that could affect imports from countries worldwide. That could raise the stakes for upcoming reports on the U.S. job market, including Friday’s, which will show how many workers employers hired during all of April.

Economists expect it to show a slowdown in hiring down to 125,000 from 228,000 in March.

The most jarring economic data recently have come from surveys showing U.S. consumers becoming much more pessimistic about the economy’s future because of tariffs. The Conference Board’s latest reading on consumer confidence will arrive on Tuesday.

In the bond market, Treasury yields held relatively steady. They’ve calmed since an unsettling, unusual rise rise in yields earlier this month rattled both Wall Street and the U.S. government. That rise had suggested investors worldwide may have been losing faith in the U.S. bond market’s reputation as a safe place to park cash.

The yield on the 10-year Treasury slipped to 4.24% from 4.29% late Friday.

In stock markets abroad, indexes were mixed across Europe and Asia. The CAC 40 in Paris rose 0.6%, but stocks slipped 0.2% in Shanghai.

___

AP Writers Jiang Junzhe and Matt Ott contributed.